Bloomberg has it that Elon Musk, the CEO of Tesla Motors Inc. is giving away the patents for the inventions to technology used in his line of electric cars in hopes of boosting Tesla and its technology. What the CEO of the company is telling everyone else in the auto industry is to “come and use our technology”. But what is such a contrarian strategy about?

Patents serve to act as legal barriers to entry against other potential firms who may want to enter the industry and protect the market power of the incumbent. In this case, the patented technology gave Tesla Motors Inc. a huge edge in the electric car industry with close to 42% market share:

This chart is credited to The Motley Fool.

It is apparent that Tesla is one of the US’s leading companies in the electric car industry.With a 42% market share, Tesla affirmed itself as strong competitor in the oligopoly market. As we can see from the chart above, the electric car industry is not run by many companies because this is still a niche market after all. The industry is still in its infancy phase because of the higher costs of implementing the technology to harness electrical energy than petroleum into auto production. What augments the barriers to entry to the main auto industry fuelled by petroleum is the long and difficult process of implementing rechargeable utilities into main gas stations country and world-wide.

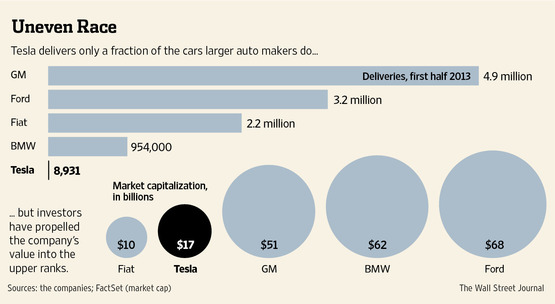

This chart is credited to Statista.

Many analysts-alike has termed this approach by CEO Elon Musk to be highly contrarian in nature, because at a time where revenue is growing for Tesla (Tesla recently broke into the Chinese electric car industry), this move to release its patents could allow more companies to use their technologies resulting in an erosion of market share for Tesla. When this happens, we could see a fall in revenue and profit margins. At a time when the industry is still in its early stage of development, this could spell doom for its companies who aspire to be here for the long run.

However, I think this move is nothing short of a stroke of ingenuity.

Even though the age-old adage of “profits come first” still figure itself in many price and non-price strategies of businesses, it has taken on a more philosophical slant in this 21st Century. Today, profit/loss ratios are no longer the holy grail of businesses and neither does it determine its long run survivability. But the sacred element that preserves businesses lie at the heart of consumer accessibility. Simply put: the more your product/technology/idea is being used by people, the higher the probability that your businesses can survive. This key idea is centred around the tendency for people to conform to herd mentality behaviours where they jump onto the bandwagon to seek identity. Look at why brands like Apple, Samsung, Facebook, Instagram and twitter constantly feature in our everyday conversations. These brands have became immortalised because the experience that users gain from their independent usage and collective consumption by society have defined the way of life for these users. This is exactly what the CEO of Tesla Elon Musk is trying to achieve over the longer term. By releasing its patents, what Musk is ultimately trying to do is to flood competitors with opportunities to contribute to the revolution of the auto-industry. By lowering revenue and profits, we can see that the electric car industry can transform itself into a more versatile industry which, eases its transition into the main auto-industry. For the supply chain, this means a possible transformation into a monopolistic competitive electric car industry. If Tesla’s technology is being harnessed by competitors alike, Elon Musk can effectively summon an army of lower cost companies on his side to attack the main auto-industry and develop this niche into something greater. For the demand side of the equation, consumers who are more concerned with green technologies will celebrate the reborn of the electric car industry. This is an extremely important step to equalizing the main auto-industry between electric cars and petroleum cars.

As we can see form the infographic above, releasing patents is in fact the only way Tesla can break ground in the main auto industry, which, Tesla is currently only a small player with a very small market share. By doing so, Tesla may see a fall in profit margins over the short term. However, brand recognition will take centre-stage over the long term. More consumers will be able to access to Tesla’s technologies. With the same collective patronage paid to brands like Apple and Instagram, consumers will immortalize Tesla in a self re-enforcing feedback loop. These people will forever see Tesla as the pioneer in this technology who transformed the auto-industry the same way they that they view Apple or Samsung as game changers in the smart phone industry.

As we can see form the infographic above, releasing patents is in fact the only way Tesla can break ground in the main auto industry, which, Tesla is currently only a small player with a very small market share. By doing so, Tesla may see a fall in profit margins over the short term. However, brand recognition will take centre-stage over the long term. More consumers will be able to access to Tesla’s technologies. With the same collective patronage paid to brands like Apple and Instagram, consumers will immortalize Tesla in a self re-enforcing feedback loop. These people will forever see Tesla as the pioneer in this technology who transformed the auto-industry the same way they that they view Apple or Samsung as game changers in the smart phone industry.

So, is eroding your own market power a form of self-destruction? Not necessarily so. The game of economics may bring it back to you after one big loop, this time in even greater percentages. The market rewards risk takers who the take right risks accordingly.

By the way, Elon Musk is also the main guy behind PayPal and CEO&CTO of SpaceX, a commercialized private company that transports logistics to space for the “exploration and colonisation of Mars”. He also inspired the persona of Tony Stark played by Robert Downey Jr. in Marvel’s Ironman and had a cameo role in Ironman 2.

Tesla Model S.

Cheers,

Jerry Ding

14th June 2014